child tax portal update dependents

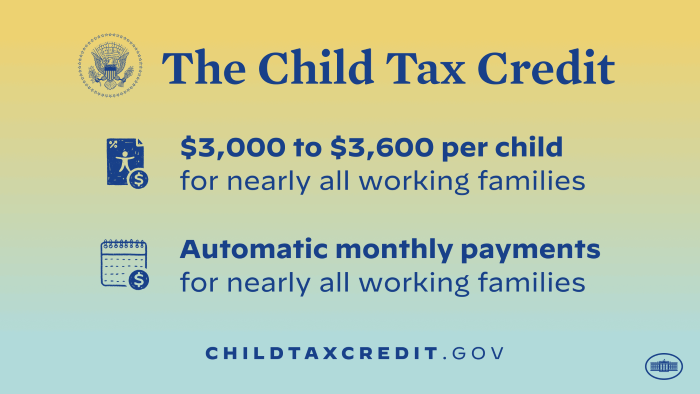

The total changes to 3000 per child for parents of six to 17 year olds or 250 per month and 1500 at tax time. Child Tax Credit Update Portal to Close April 19.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

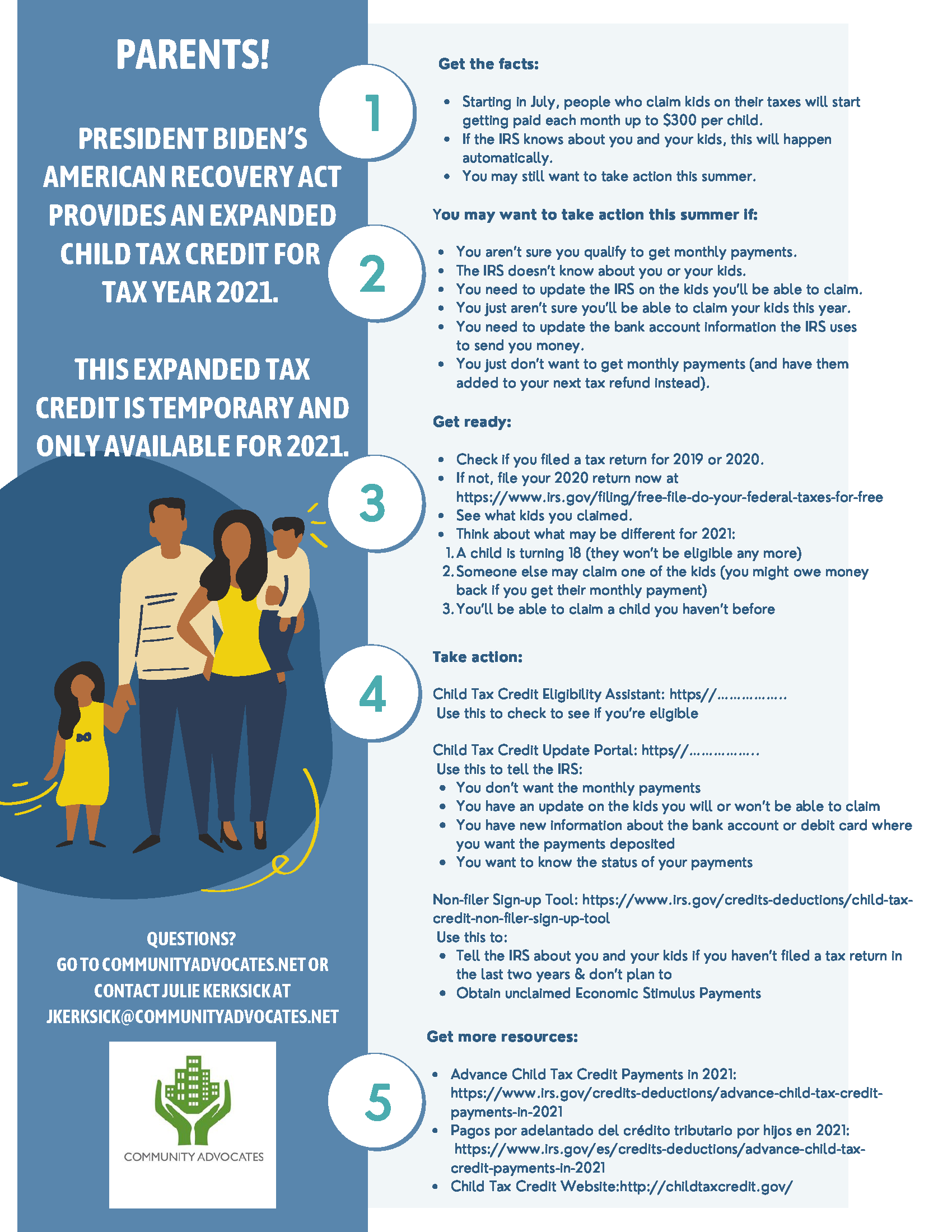

. Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet Admission Open For Preschool And Daycare Childhood Is Not A Contest To Analyze How Swiftly A Kid Can Read Write Starting A Daycare Preschool Opening A Daycare. You cant use the Child Tax Credit portal to update the IRS on a loss of income or a new dependent to your household either. June 29 2021 1200 PM The Update Portal for adding a dependent is not available yet.

In order to claim someone as your dependent the person must be. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving.

This tool can be used. Wait 10 working days from the payment. Government will then vet the supporter to ensure that they are able to financially support the.

Eligibility is based on your childs age at the end of this calendar year. It also lets recipients view. It provides 2000 in tax relief per qualifying child with up to 1400 of that refundable subject to an earned income threshold and.

For each dependent that doesnt qualify for the Child Tax Credit taxpayers may qualify for a 500 Credit for Other Dependents. The IRS will pay 3600 per child to parents of young children up to age five. Unmarried or if married not filing a joint return or only filing a joint return to claim a refund of income tax withheld or estimated tax paid.

To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child tax credit portal. Once that functionality is available you can use the Child Tax Credit Update Portal to submit your new dependents information to the IRS and update your payment amount. The amount increased from a maximum of 2000 per child to.

The IRS will make a one-time payment of. 19 hours agoPeople can also get any pandemic stimulus payments they are still owed through the portal. If something happens that you are unable to get the payments you can still get the full child tax credit for that child when you.

Heres how they help parents with eligible dependents. These can include certain dependents 17 or. Families should enter changes by November 29 so the changes are.

A nonfiler portal lets you provide the IRS with basic information about yourself and your dependents if you normally. See Q F3 at the following link on the IRS web site. The IRS says it will be available later this year If you dont get all the payments for your new child during the year you will be able to claim the missing amount as a credit on your.

Heres how they help parents with eligible dependents. It says on the IRS website that the first payment will be based upon the dependents you put on your 2019 2020 tax return. The Update Portal for adding a dependent is not available yet.

The tool also allows families to unenroll from the advance payments if they dont want to receive them. COVID Tax Tip 2021-167 November 10 2021. The first step in the Uniting for Ukraine process is for the US-based supporter to file a Form I-134 Declaration of Financial Support with USCIS.

Either your qualifying child or qualifying relative. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. Half of the money will come as six monthly payments and.

Families can now report income changes using the Child Tax Credit Update Portal. June 28 2021. That drops to 3000 for each child ages six through 17.

The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child tax credit payments to update their income. National or a resident of Canada or Mexico. That means all qualifying children there are other requirements we explain below born.

The child tax credit was changed significantly in 2021 making it fully available for the first time to the lowest-income families including those who typically do not have to file a tax return. Open a GO2bank Account Now. Child Tax Credit Payment Schedule for 2021.

The Update Portal is available only on IRSgov. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. Child tax portal update dependents Wednesday March 2 2022 Edit.

The 500 nonrefundable Credit for Other Dependents amount has not changed. The IRS says it will be available later this year If you dont get all the payments for your new child during the year you will be able to claim the missing amount as a credit on your 2021 tax return. You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year.

The IRS is paying 3600 total per child to parents of children up to five years of age. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. Child Tax Credit Update Portal.

This secure password-protected tool is easily accessible using a smart phone or computer with internet. At some point the portal will be updated to allow you to update how many dependants you have.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

2021 Child Tax Credit Payments Does Your Family Qualify

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

Child Tax Credit What We Do Community Advocates

2021 Child Tax Credit Includes July 15 Advances Freed Marcroft Llc

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 8 Things You Need To Know District Capital

Haven T Had The Child Tax Credit Payments Here S How To Trace Your Check

Did Your Advance Child Tax Credit Payment End Or Change Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

How The New Expanded Federal Child Tax Credit Will Work Missouri Independent

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information The Georgia Virtue

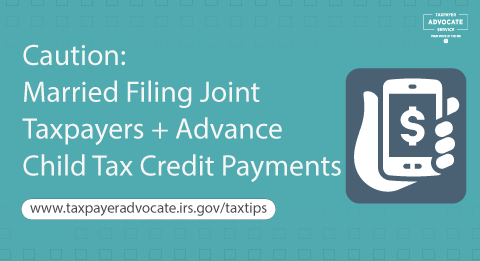

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

Monthly Child Tax Credit Payments Begin Arriving For Families July 15 Kentucky Center For Economic Policy

Tas Tax Tip Ten Things To Know About Advance Child Tax Credit Payments Taxpayer Advocate Service