indiana estate tax return

This all-important number will represent the estate in all tax situations. According to IC 6-3-4-1 and for taxable years beginning after Dec.

Its the job of the personal representative the executor named in the will to file the inheritance tax return if one is required.

. The full table of Rhode Island estate tax rates is available on the states estate tax return Form RI-100A. Welcome to INtax Indianas free online tool to manage business tax obligations for the following Indiana taxes. Due Date - Individual Returns - April 15 or same as IRS Extensions - Indiana requires all individual income taxpayers that do not file by the original due date to file an extensionIndiana will allow taxpayers an additional 30 days after a federal return on extension is due.

Editors frequently monitor and verify these resources on a routine basis. Just one return is filed even if several inheritors owe inheritance tax. Inheritance Tax Refunds In general estates or beneficiaries of Indiana residents are required to file an inheritance tax return Form IH-6 if.

Related

On your summer or vacation home. AMENDED RETURN An amended return must be filed to report changes to an orig-. You can choose from a list of multiple.

We last updated Indiana Income Tax Instructions in March 2022 from the Indiana Department of Revenue. Ad Free IRS E-Filing. Therefore you must complete federal Form 1041 US.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Indiana government. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. If an estate is large enough Form 706 the United States Estate Tax Return is due to the IRS within nine months of the death of the deceased with a 6-month extension permitted.

Nonresident estate or trust having any gross income from sources. To 430 pm Monday through Friday with the exception of major holidays. Estate or a trust is sometimes referred to as a pass-through entity.

E-File Your Tax Return Online - Here. View listing photos review sales history and use our detailed real estate filters to find the perfect place. That process outlined in Indiana Senate Bill 923 will take ten years completely eliminating the tax in 2022.

Dying With a Will in Indiana. Most estates and trusts file Form 1041 at the federal level and file Form IT-41 at the Indiana level. All district offices have hours from 8 am.

The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source. If the IRS instructs you to complete a Form 706 US Estate Tax Return then the Indiana-equivalent form is the IH-6 Indiana Inheritance Tax Return. Two ways to check the status of a refund.

The gift tax return is due on April 15th following the year in which the gift is made. Eligible Indiana taxpayers can file both the federal and Indiana individual tax returns using highly interactive and easy-to-use web-based applications that speed both returns and refunds. Indiana Income Taxes and IN State Tax Forms Step 1.

Indiana Estate Planning Elder Law Hunter Estate Elder Law is an estate planning and elder law firm with a focus on asset protection wills trusts Medicaid planning Veterans benefits long-term care planning probate with trust administration and probate avoidance. Zillow has 1542 homes for sale. Help others by sharing new links and reporting broken links.

Indiana Tax Records Search Links. A deduction up to 2500 is available to taxpayers who paid property taxes paid on their main home. General Tax Return Information.

If you claim the Lake County residential income tax credit for the same tax year. 31 2012 every resident estate or trust having gross income or. The state income tax.

If theres no probate court proceeding and so no personal representative has been. You cannot take this deduction. Ad Find Recommended Indiana Tax Accountants Fast Free on Bark.

Check your Indiana Tax Refund Status. Filing a typical tax return is simple but completing one in the name of a decedents estate requires a little more work. This tax season Indiana continues to offer a free tax filing service through the cooperation of the Free File Alliance.

The Indiana Tax Records Search links below open in a new window and take you to third party websites that provide access to IN public records. The individual federal estate tax exemption is 117 million for 2021 so an estate smaller than 117 million may not be faced with estate taxes unless the deceased individual made substantial. Forms are available on our website at wwwingovdor3509htm or you may contact their office at 317 232-2154.

Income Tax Return for Estates and. The returns submitted for the tax type account can be sorted by the document locator number form type period end date and submission date. You can apply online by fax or via mail with the IRS to receive an employer identification number EIN.

Calling 1-800-TAX-FORM 800 829-3676. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return. By telephone at 317-232-2240 Option 3 to access the automated refund line.

31 rows Generally the estate tax return is due nine months after the date of death. Many of the necessary determinations are done at the federal level by the IRS. Contact a district office of the Indiana Department of Revenue see Resources.

Please allow 2-3 weeks of processing time before calling. Can I take the Indiana Homeowners Residential Property Tax Deduction. Select one of the column titles highlighted by the red box to sort by that.

All district offices in Indiana have access to copies of your prior year tax returns. Planning 2014s Taxes with Your 2013 Tax Return. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related.

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

Why Some Americans Should Still Wait To File Their 2020 Taxes

Waiting On Tax Refund What Return Being Processed Status Really Means Gobankingrates

Pin By Indiana Tech On Prepare For Life After College Probate Will And Testament Last Will And Testament

How To File Taxes For Free In 2022 Money

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

Fake Tax Return Refund Yearly Income Gross Net Profit Loss Signed Verification Proof Irs Statement Mortgage Loans Validati Tax Return Tax Fake

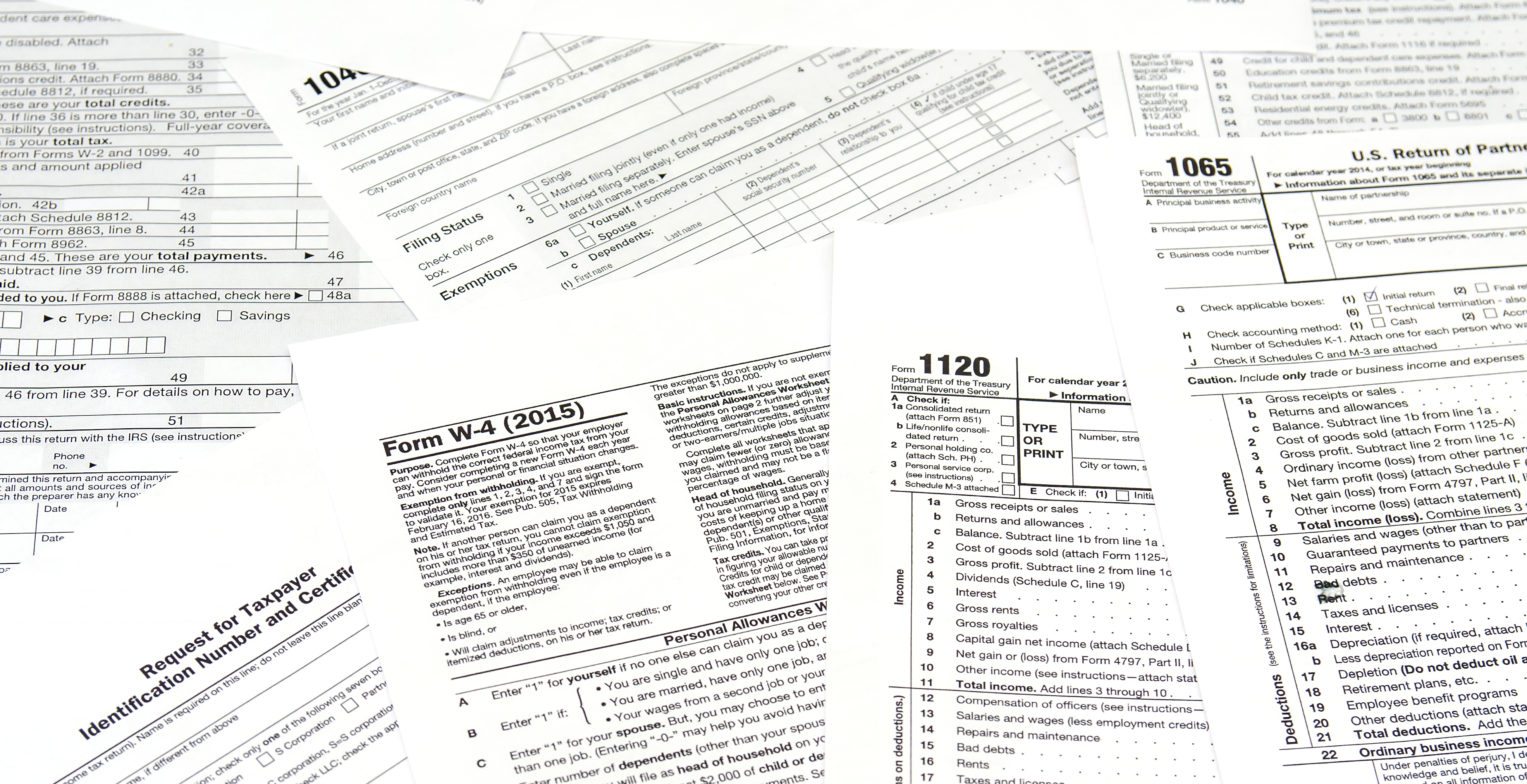

Understanding The 1065 Form Scalefactor

Smaller Tax Refund This Year Here Is Why And How To Fix It Next Time

Prepare E File Mail Year End Tax Forms 5498 1099 W 2 1095 Pricing Starts As Low As 0 50 Form Also File 940 941 944 Irs Forms Filing Taxes Tax Forms

How To File Income Tax Returns For An Estate 14 Steps

How Long Does It Take To Get A Tax Refund Smartasset

Irs Releases Draft Form 1040 Here S What S New For 2020

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Tax Refund Millions See Extra 125 After Filing Taxes Fingerlakes1 Com

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

Form 1120 S U S Income Tax Return For An S Corporation Definition